Our strategy and business model

Storebrand delivers security and financial freedom to private individuals and companies. We want to motivate our customers to make good and sustainable financial choices. Together, we can create a future to look forward to. This is our aim as we strive to create value for customers, shareholders, and society.

Strategy 2023-25

Leading the way in sustainable value creation.

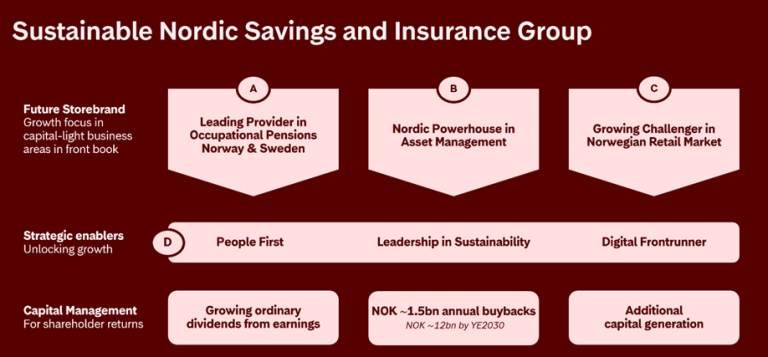

Storebrand’s strategy aims to provide an attractive combination of capital efficient growth within what we call Future Storebrand, and capital release from the Guaranteed pensions business that is closed for new business and is in run-off.

Storebrand aims to:

- be the leading provider of occupational pensions in both Norway and Sweden

- continue building a Nordic powerhouse in asset management

- ensure rapid growth as a challenger in the Norwegian retail market for financial services

The interaction between our business areas provides synergies in the form of capital, economies of scale, and value creation based on customer insight. As announced on the Capital Markets Day in December 2023, our ambition is to deliver a group profit (before amortisation and tax) of approximately NOK 5 billion in 2025.

To unlock the growth ambitions, Storebrand actively seek to utilize three strategy enablers (D). To succeed with the goals and create a future to look forward to, we need employees who are competent and brave pioneers. We believe the only way to secure a better future is to take part in creating it. Therefore, we seek to actively use our position to lead the way in sustainable value creation and to differentiate ourselves from competitors. The use of technology makes it possible to combine growth initiatives and measures for increased competitiveness, while at the same time realising cost reductions and efficiency gains.

We aim (I) to grow the ordinary dividend from our earnings, (II) to return approximately NOK 1.5 billion annually via share buybacks through 2030, amounting to a total of NOK 12 billion and (III) to generate additional capital to be available for further growth or distribution to shareholders.

To learn more about the strategy and business model, please view the presentation from our Capital Markets Day in December 2023.

For more detailed information about our products and their result generation, please see our comprehensive guide for investors and analysts: