1767–1919: The beginning

1767: "Den almindelige Brand-Forsikrings-Anstalt" is established in Copenhagen.

1814: After secession from Denmark, the scheme is continued and the administration transferred to Christiania. From 1913, the scheme is converted into a public company and is named Norges Brannkasse.

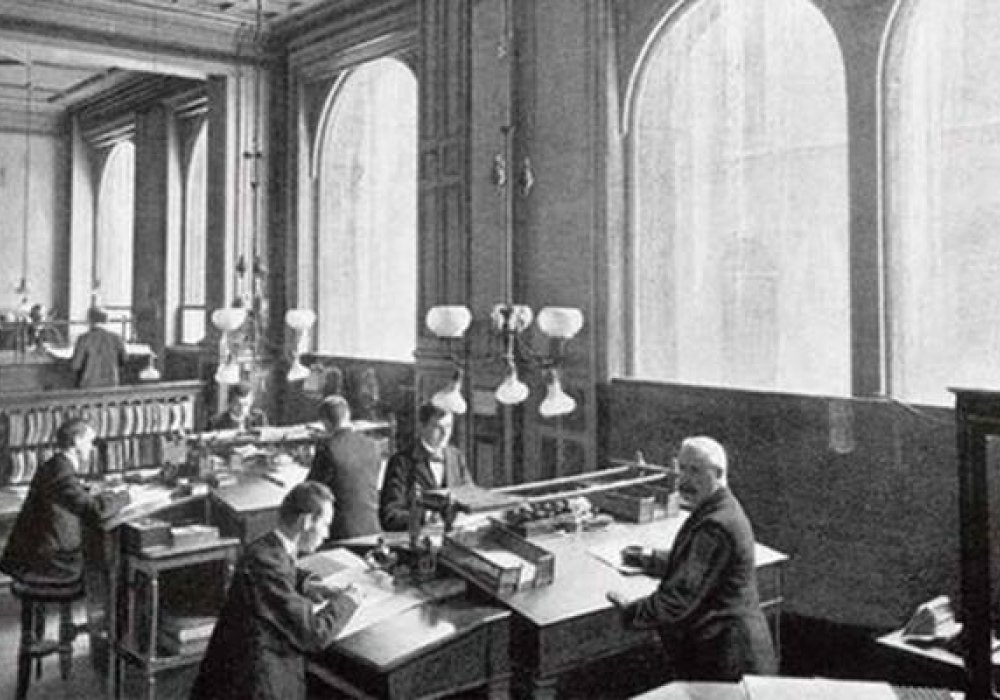

1847: On 4 May 1847, private interests establish "Christiania almindelige Brandforsikrings-Selskab for Varer og Effecter". The company is referred to as Storebrand.

1861: Storebrand's owners establish Norway's first privately owned life insurance company "Idun".

1867: The Non-life insurance company Norden is established as a competitor to Storebrand.

1917: The life insurance company Norske Folk is founded.

1920–1969: Growth and consolidation

1923: Storebrand buys almost all the shares in Idun. With a few exceptions, the rest will be taken over during the 1970s.

1925: Storebrand changes its name from Christiania almindelige Forsikrings-Aksjeselskap (renamed 1915) to Christiania almindelige Forsikrings-Aksjeselskap Storebrand. The name is retained until 1971.

1936: Storebrand acquires Europe, Norway's leading travel insurance company.

1962: Storebrand begins a new wave of acquisitions and mergers by taking over Norrøna, which had run into financial problems.

1963: Storebrand takes over Norske Fortuna. Brage and Fram merge to become the country's largest life company. Storebrand and Idun move to their newly renovated office building in Vika. Brage-Fram and Norske Folk follow suit.

1970–1989: Group formation

1978: Storebrand changes its logo and introduces the "link" as an easily recognizable trademark. The formal name of the holding company is changed to A/S Storebrand Group.

1983: The Nordic Group and the Storebrand Group merge.

1984: Norske folk and Norges Brannkasse market themselves as one entity under the name UNI Forsikring.

1990–1999: Crisis and transformation

1990: Storebrand and UNI Forsikring decide to merge and receive a formal licence in January 1991.

1992: UNI Storebrand fails in negotiations with Skandia on the establishment of a Norwegian-led Nordic major company.

1996: The company changes its name to Storebrand ASA and establishes Storebrand Bank ASA.

1999: Storebrand, Skandia and Pohjola merge their non-life insurance business into the new Nordic Swedish-registered company "If Skadeförsäkring ab". Storebrand sells out five years later.

2000-2011: New challenges

2000: Norwegian and international equity markets fell sharply from September 2000 to February 2003.

2005: The Storting (Norwegian parliament) decides that all companies shall have introduced occupational pensions (OTP) by 2007. Storebrand meets the challenge with its product "Storebrand Folkepensjon".

2006: Storebrand decides to re-enter non-life insurance.

2007: Storebrand acquires the Swedish pension company SPP from Handelsbanken and forms the leading life and pension insurance group in the Nordic region.

2008: The financial crisis in the US spreads to global financial markets, and in 2008 the New York Stock Exchange (Dow Jones) fell by 34 per cent and the Oslo Stock Exchange by 54 per cent.

2009: Storebrand confirms that talks have been held about a possible merger with Gjensidige. The talks ended without results

2010: Storebrand emerges well from the financial crisis. Hard work is being done to prepare both employees and customers for the new pension reform, which will come into force on 1 January 2011. Storebrand receives a lot of attention for its new energy-efficient headquarters.

2011: A new group organisation makes it easier to be a customer at Storebrand. The debt crisis and uncertainty in the euro area are creating great fear and turbulence in the financial market. Storebrand's annual results are characterised by these disturbances.

2012 - present: A future to look forward to

2012: Storebrand launches a new vision: "Our customers recommend us". Odd Arild Grefstad is appointed new CEO. Extensive change work related to capital efficiency, cost reductions, customer orientation and commercialization is initiated.

2014: New framework conditions for private occupational pensions in Norway are introduced on 1 January. New maximum rates for defined contribution pensions are increased significantly. Storebrand Kapitalforvaltning has passed NOK 500 billion in assets under management. The law on paid-up policies with investment choices comes into force on 1 September.

2015: Storebrand enters into new agreements to deliver defined contribution pension schemes to major players such as NHO and NRK and Statoil. In November, Storebrand signs a strategic cooperation agreement with the American IT company Cognizant, which at the same time acquires 66 percent of Storebrand Baltic. The collaboration lays the foundation for an even more customer-oriented development of the Group's IT solutions. Storebrand was chosen as Akademikerne's new partner on insurance.

2016: The main organisation Unio and Storebrand enter into an agreement that offers the members of Unio's association a mortgage at one of the market's best lending rates. This will contribute to increased growth for the Bank. In Sweden, we are launching Pluss funds, which are fossil-free, index-oriented funds with a high sustainability rating – and the funds sell very well. Storebrand launches "Our Driving Force". Our driving force is about what Storebrand stands for. We create security today and a future you can look forward to.

2017: Storebrand celebrates its 250th anniversary!

2019: Storebrand acquires the investment company Cubera Private Equity AS, which manages several private equity funds in the Nordic region and internationally

2020: Storebrand is included in the Dow Jones Sustainability Index, ranked as one of the world's 10 percent most sustainable listed companies.

2021: Storebrand's capital management exceeds NOK 1000 billion

2022: Storebrand acquires Danica Pensjon Norway and the Investment app Kron, and introduces a policy on nature for investments.

2023:More customers choose Storebrand, double-digit growth in pensions, asset management and insurance.

2024: Storebrand delivers record-breaking results and strong growth in all focus areas. Acquires the Danish infrastructure manager AIP and its head office in Lysaker.